direct deposit owner's draw quickbooks

In the Write Checks box click on the section Pay to the order of. We also show how to record both contributions of capita.

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

Have your employees fill out sign and date a direct deposit authorization form and attach a voided check from the employees bank account not a deposit slip.

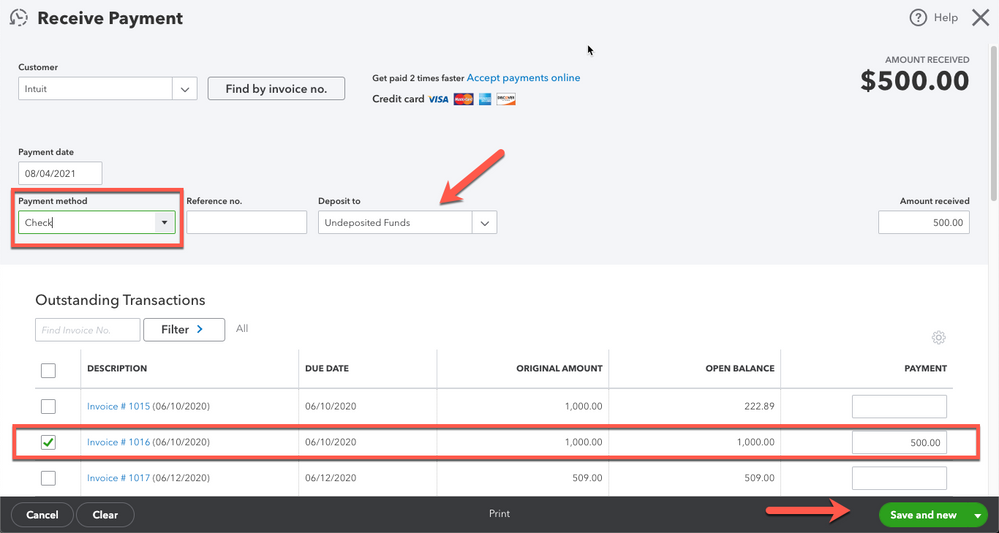

. Once you have your slip of the deposited balance from your bank youre ready to record. Then choose the option Write Checks. Hit on Payroll Info and choose Direct Deposit.

Click Save Close. Click OK when done and then click OK on the employee screen to make sure the. Hi nadams1 thank for posting in quickbooks community.

Once done heres how to write a check. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. Select Use Direct Deposit for checkbox and then select whether to deposit the paycheck into one or two accounts.

This article is for business owners and accountants looking to process payroll through QuickBooks Online. Now choose the new button. If you need to re-categorize a transaction and move it to a different account select UndoThis sends the transaction back to the For Review tab.

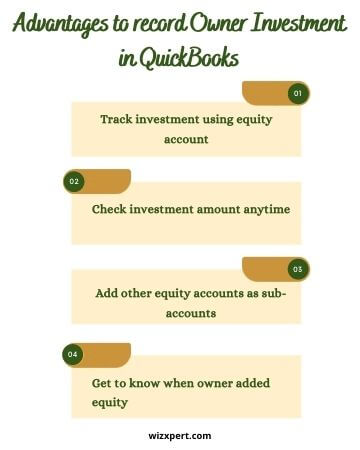

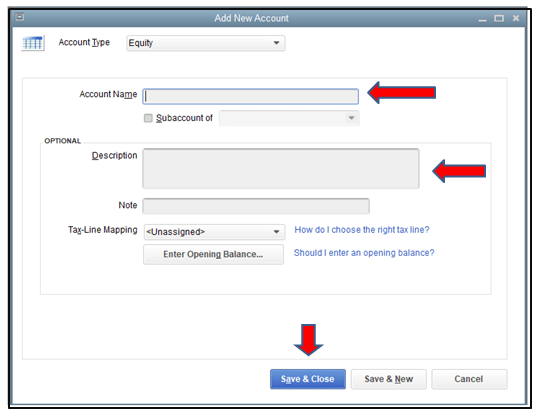

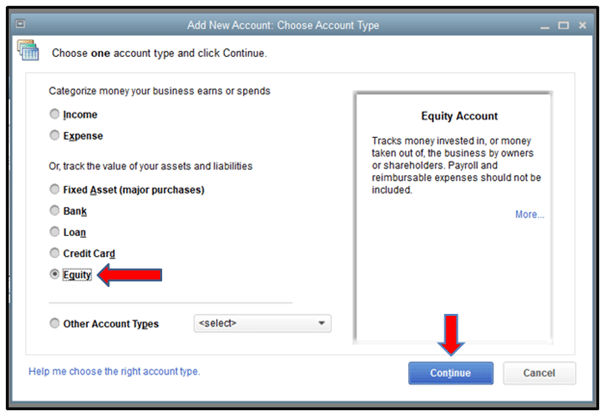

Step 2 Employee Direct Deposit Authorization Review the information at the top of the page and proceed by entering the following information in the section. To create an owners draw account. Create an Owners Equity account.

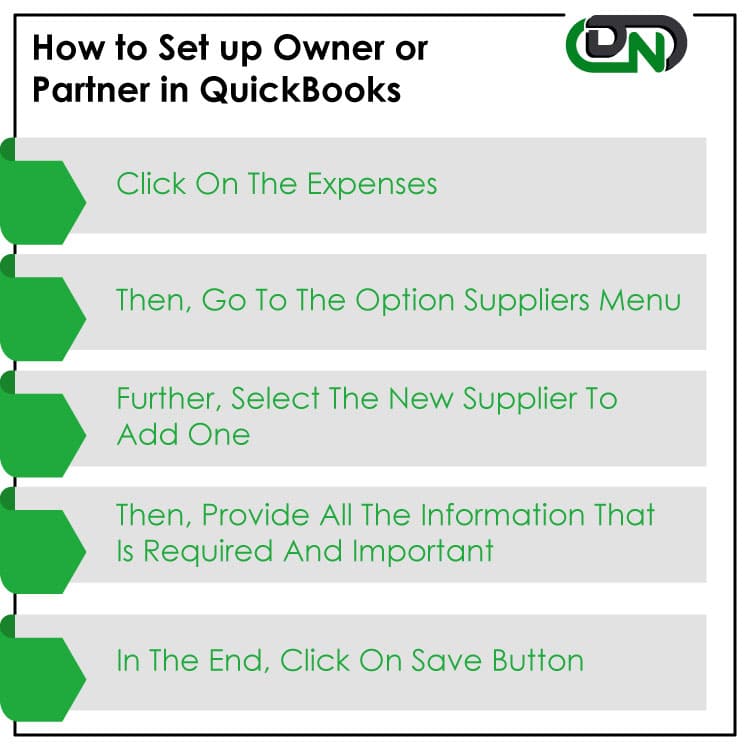

Using QuickBooks payroll direct deposit will save you time and money. This employee box and enter the following information. Click the New option at the upper right.

To Write A Check From An Owners Draw Account the steps are as follows. Filter the list so that only vendors marked for payment by Direct Deposit appear. Now enter the amount followed by the symbol.

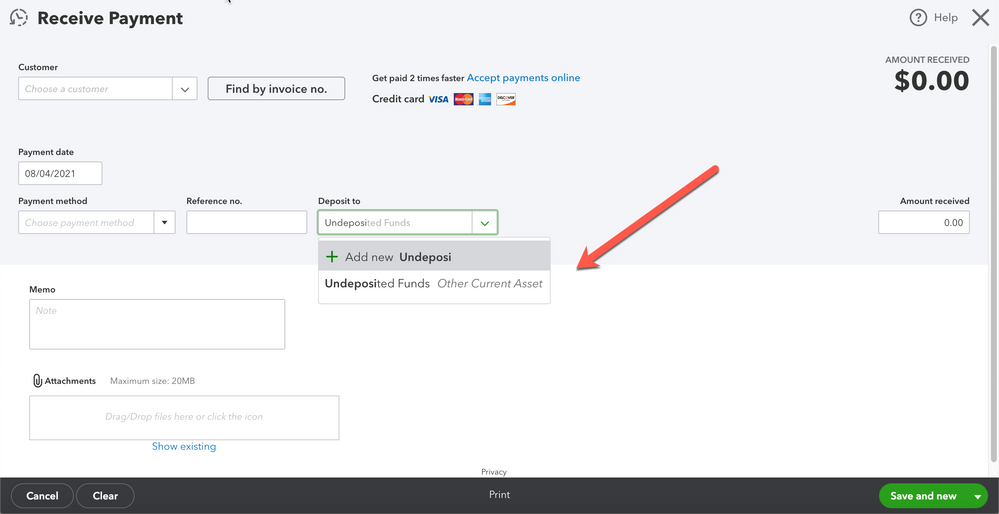

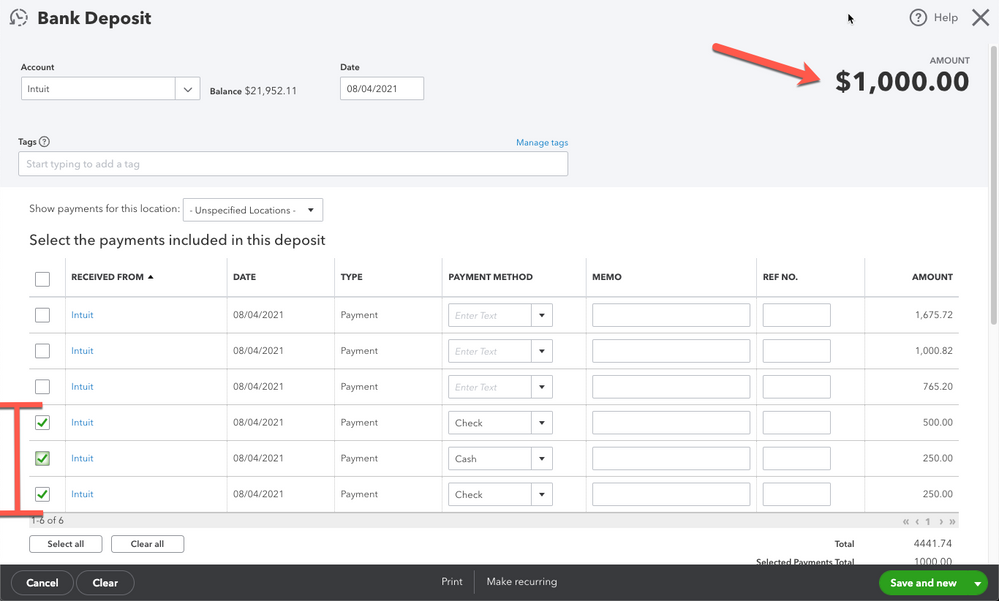

In the Payments to Deposit window you need to select the payments you wish to combine. Pick Equity in the Account Type drop-down then choose Owners Equity in the Detail Type. When entering a check written to the owner for personal expenses post the check to her draw.

Pay bills from your vendors through Direct Deposit. From the Account Type dropdown choose Equity. Check the Use Direct Deposit for this employee box.

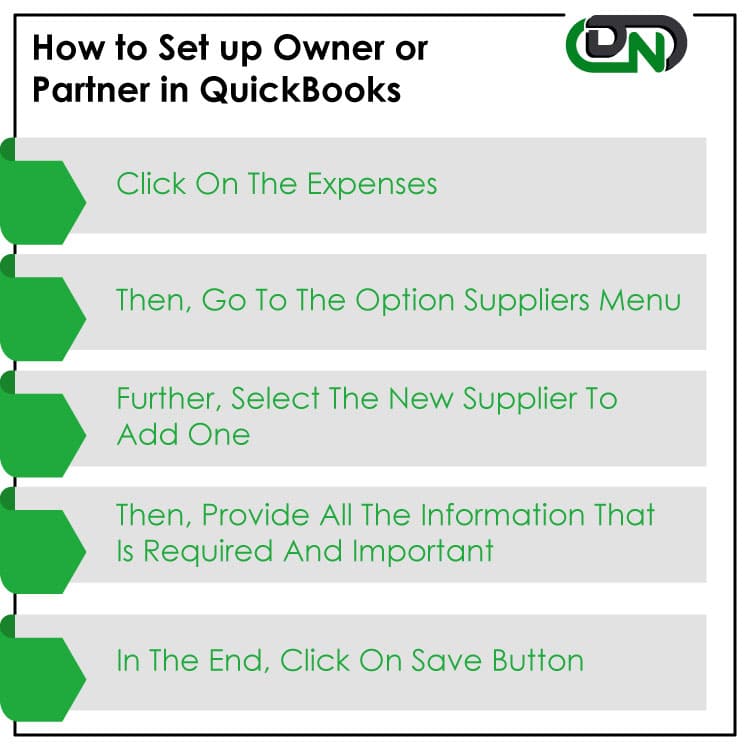

Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. Before you can pay an owners draw you need to create an Owners Equity account first. October 15 2018 0559 PM.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. If you have any video requests or tutorials you would like to see make sure to leave them in the com. When you enter bills from your vendor invoices in QuickBooks Desktop you have the option to pay them through Direct Deposit.

Create the paychecks in QuickBooks. Easier pay the owner draw with transfer in bank account then recategorized the account to owner draw. Start paying employees using Direct Deposit.

Now you need to choose the owner and enter an. Go to the Gear icon in order to open the QuickBooks Settings. Hit OK to finish.

Heres how you create an Owners Equity account. Click the Banking tab in the main menu bar at the top of the screen. Before registering the contribution of the owner you must have a particular equity account.

Go to the Vendors menu then select Pay Bills. Select the vendor you want to pay. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

Here you can choose the Chart of Accounts menu. In QuickBooks Desktop software. First of all login to the QuickBooks account and go to Owners draw account.

Enter the account name Owners Draw is recommended and description. Go to Settings and select Chart of accounts. With QuickBooks Online Payroll you can keep all your W-9 contractors info in one place.

Use it to add your direct deposit info and review your direct deposit checks. Visit Employee and tap Employee Center. Click to see full answer.

This will enable you to download the IntuitQuickbooks Payroll Direct Deposit Form as a PDF document. Click on the Banking and you need to select Write Cheques. See Set up your company payroll for direct deposit for detailed steps.

In this learn QuickBooks training tutorial you will learn how to record cash investment in to the company deposited by the owner from his her own money p. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership. Click on the Banking menu option.

Click the Use Direct Deposit for. You can also choose whether to direct deposit the whole amount or split the amount. Dont forget to like and subscribe.

Smith Draws Post checks to draw account. At the bottom left choose Account New. Click Equity Continue.

Recording a Bank Deposit in the QuickBooks to Combine Payments. Get a direct deposit authorization form. For additional information here i give you article about setup owner draw account.

In the Chart of Accounts window select New. Enter the employees financial institution information and then click OK to save the information. In the window of write the cheques you need to go to the Pay to the order section as a next step.

In QBO go to the Accounting menu at the left pane to get to the Chart of Accounts page. For each employee you want to pay by. Select Make Deposits from the drop-down menu.

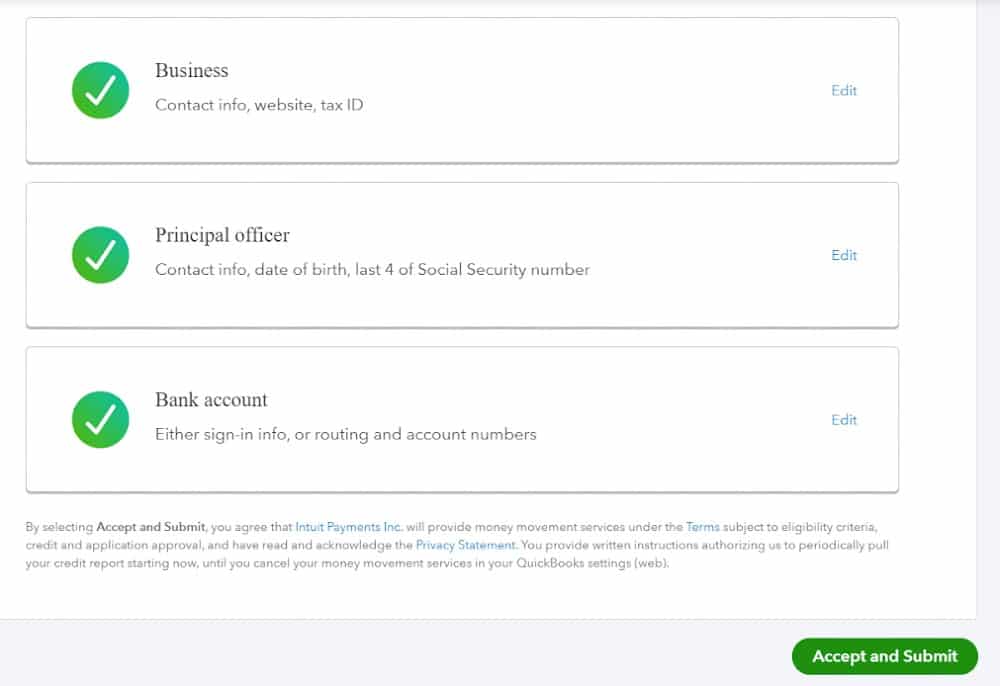

Bank name account number account type and routing number. Enter an opening balance and hit Save and close. Well go over how clients should set.

This makes paying them easy. Enter the employees bank account type bank name account and routing numbers. Choose the employee for which you are setting up the direct deposit.

Step 1 Locate the image on the right and select the PDF button below it. Make an Owners Equity Account. Set up your company payroll for direct deposit.

As the contractor you can use the same special QuickBooks Self-Employed account you used for your W-9. On the Homepage you need to choose Record DepositsMake Deposits. In this section click on the Owner.

If QuickBooks displays the Payments to Deposit window click to select the payment and the investment check that you want to deposit and then click the OK button.

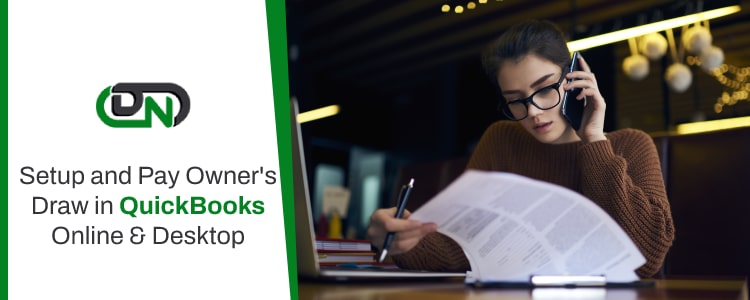

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How To Pay Employees With Direct Deposit In Quickbooks Desktop Payroll Youtube

Getting Started In Quickbooks Online Payroll Quickbooks Training Webinars Youtube

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

How Do I Pay Myself Owner Draw Using Direct Deposi

Using Undeposited Funds In Quickbooks Online

How To Record Owner Investment In Quickbooks Set Up Equity Account

How To Record Owner Investment In Quickbooks Set Up Equity Account

Using Undeposited Funds In Quickbooks Online

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

How Can I Pay Owner Distributions Electronically

Using Undeposited Funds In Quickbooks Online

How To Set Up Pay Payroll Tax Payments In Quickbooks

Quickbooks Online Payroll Settings Features Core Premium Elite Youtube

How To Record Owner Investment In Quickbooks Set Up Equity Account

Understanding Quickbooks Lists Chart Of Accounts Informit